Most people think their therapy copay is the whole story. You see $30 on your insurance card, assume that’s what you’ll pay per session, and budget accordingly. But that’s only the tip of the iceberg. If you’re paying for therapy long-term - and most people need 12 to 20 sessions to see real change - the real cost adds up fast. And if you haven’t met your deductible yet? You could be paying hundreds per session before your copay even kicks in.

What You’re Really Paying: More Than Just the Copay

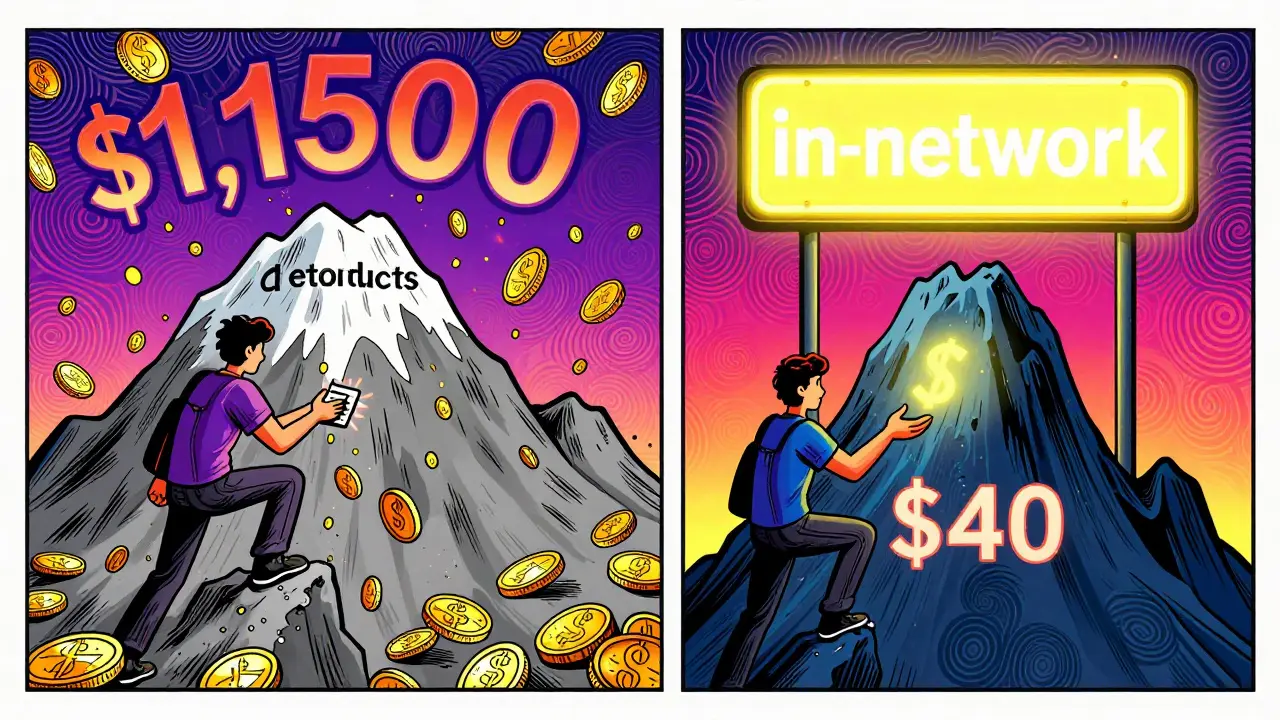

Your copay isn’t the full price of therapy. It’s just the portion your insurance lets you pay after you’ve met other financial obligations. To know what you’ll actually spend, you need to understand three key pieces: your deductible, your coinsurance, and whether your therapist is in-network or out-of-network.Let’s say your therapist charges $125 per session. Your insurance says your copay is $30. Sounds good, right? But if your annual deductible is $1,500, you’ll pay the full $125 for each session until you’ve spent $1,500 out of pocket. That’s 12 sessions before your copay even applies. By then, you’ve already paid $1,500 - not $30.

And if your plan uses coinsurance instead of a flat copay? That’s even trickier. Let’s say you have a 20% coinsurance after your $3,000 deductible. That means once you hit $3,000, you still pay 20% of every session’s allowed amount. If your therapist’s allowed rate is $125, you pay $25 per session after the deductible. But if you need 20 sessions total? You’re looking at $3,000 (deductible) + $500 (20 sessions × $25) = $3,500 total. That’s not $30 per session. That’s nearly $175 per session on average.

In-Network vs. Out-of-Network: A Big Difference in Your Wallet

Choosing a therapist who’s in-network can save you hundreds - or even thousands - over the year. In-network providers have agreed to accept your insurance’s negotiated rate. That means if your insurance says the allowed amount for a session is $125, the therapist can’t charge you more than that.Out-of-network therapists? They can charge whatever they want. Your insurance might only cover a portion of that cost - often based on what they consider “usual and customary” in your area. If your out-of-network therapist charges $200 per session, but your insurance only allows $125, you pay the full $200 upfront. Then your insurance reimburses you 50% of the allowed amount ($62.50). So you’re out $137.50 per session. That’s more than double what you’d pay in-network.

And here’s the kicker: out-of-network payments usually don’t count toward your in-network deductible or out-of-pocket maximum. So you’re paying more, and getting less coverage in return.

What About Medicare and Medicaid?

If you’re on Medicare, the math changes again. Medicare covers 80% of the approved amount for therapy. That means you pay 20% - plus any Part B deductible. For a $143 session, that’s about $28.60 per session after the deductible. But if you have a Medigap Plan G, it covers that 20% coinsurance. So your out-of-pocket drops to just the Part B deductible - usually around $226 for 2025.Medicaid plans vary by state, but most have little to no copay for therapy. In many cases, you’ll pay nothing out of pocket. That’s a huge difference compared to private insurance plans.

How Many Sessions Will You Really Need?

Most people think therapy is a short-term fix. But data shows that’s not usually the case. According to Grow Therapy’s 2023 analysis, 50% of patients need 15 to 20 sessions to see meaningful improvement in symptoms like anxiety or depression. For trauma, PTSD, or chronic conditions, it’s often 25+ sessions.So if you’re paying $40 per session after your deductible, and you need 20 sessions? That’s $800. If you’re paying $125 per session before your deductible? That’s $2,500 before insurance even helps. Add in monthly premiums - which average $200-$400 per month for individual plans - and you’re looking at over $3,000 just for therapy in a year, even with insurance.

Out-of-Pocket Maximums: The Safety Net

Every insurance plan has an out-of-pocket maximum - the most you’ll pay in a year for covered services. In 2025, that cap is $9,350 for individuals and $18,700 for families. Once you hit that number, your insurance pays 100% of covered therapy costs for the rest of the year.But here’s what most people miss: only in-network services count toward this cap. Out-of-network payments don’t always roll in. And some plans have separate deductibles for mental health and medical care. So if you’ve spent $5,000 on your knee surgery, that doesn’t help you meet your mental health deductible.

That’s why tracking your spending matters. Check your insurance portal every few months. Look for: total paid toward deductible, total paid toward out-of-pocket max, and how many therapy sessions you’ve had.

What If You Don’t Have Insurance?

About 1 in 5 Americans don’t have mental health coverage. But therapy doesn’t have to be $150+ per session. Sliding scale fees are more common than you think. Thriveworks’ 2024 data shows 42% of private therapists offer income-based rates - often cutting costs by 30-50%. A $125 session might drop to $60 or $70.Platforms like Open Path Collective connect uninsured people with therapists who charge $40-$70 per session. University training clinics, staffed by supervised grad students, often charge 50-70% less than private practices. Some community centers even offer free group therapy.

These aren’t last resorts - they’re realistic options. And they’re worth exploring even if you have insurance but a high deductible. If you’re paying $125 per session until you hit your $1,500 deductible, you might as well switch to a sliding scale provider for the first 10-12 sessions. You’ll save money and still get the care you need.

How to Build Your Real Therapy Budget

Here’s how to calculate your actual cost, step by step:- Find your plan type: Is it copay, deductible, or coinsurance? Check your insurance summary or call your provider.

- Confirm your therapist’s network status: In-network or out-of-network? Ask the therapist directly - don’t rely on your insurance website.

- Ask for the allowed amount: What’s the maximum your insurance will pay per session? That’s the number that matters for coinsurance.

- Estimate your session count: Plan for 12-20 sessions, unless your provider says otherwise.

- Calculate Phase 1 (pre-deductible): Full session cost × sessions until deductible is met.

- Calculate Phase 2 (post-deductible): Copay or coinsurance × remaining sessions.

- Add your monthly premium: Multiply by 12. That’s a fixed cost, even if you don’t use therapy.

- Check your out-of-pocket max: Will you hit it? If yes, your cost stops after that point.

Example: You have a $1,500 deductible, $40 copay, and a $125 session rate. You plan for 20 sessions.

- Phase 1: $125 × 12 sessions = $1,500 (deductible met)

- Phase 2: $40 × 8 sessions = $320

- Total therapy cost: $1,820

- Plus $2,400 in annual premiums = $4,220 total

That’s not $600. That’s over $4,000.

Tools to Help You Track It

You don’t have to do this alone. Use these tools:- Your insurance portal - search for “mental health benefits” or “cost estimator.”

- Alma’s free Cost Estimator Tool - enter your insurance and therapist to see your exact out-of-pocket.

- Rula’s calculator - shows average costs by plan type and location.

- GoodRx Mental Health - compares therapy prices and finds discounts.

And don’t forget: transportation, time off work, and childcare can add $50-$100 per week. Include those in your budget too.

Final Tip: Timing Matters

If you’re close to hitting your deductible, consider starting therapy in the last quarter of the year. That way, you pay full price now - but it counts toward next year’s deductible. You’ll reset your financial reset point, and your copay will kick in sooner.Or, if you’re near the end of your out-of-pocket max, push your last few sessions into the next year. You might pay more per session, but you’ll avoid paying more than you have to.

Therapy isn’t just about your mental health. It’s a financial decision too. And if you don’t understand the real cost, you’ll get stuck - either in therapy you can’t afford, or in silence because you’re afraid of the bill.

Is my therapy copay the only thing I pay?

No. Your copay is just the portion you pay after meeting your deductible. Before that, you pay the full session rate. You may also owe coinsurance - a percentage of the allowed amount - even after your deductible is met. Plus, your monthly insurance premium adds to your total cost.

What’s the difference between in-network and out-of-network therapy?

In-network therapists agree to your insurance’s negotiated rate. You pay a set copay or coinsurance. Out-of-network therapists can charge more, and your insurance may only reimburse you a portion - often based on a lower “allowed amount.” You pay the difference, and those payments may not count toward your out-of-pocket maximum.

Do I have to pay my deductible before therapy is covered?

Yes - for most plans. You pay the full cost of each therapy session until you’ve spent your deductible amount. Only after that does your copay or coinsurance apply. Some plans have separate mental health deductibles, so your medical expenses (like doctor visits) might not count toward your therapy deductible.

How many therapy sessions do most people need?

Most people see improvement after 12-16 sessions. But for complex issues like trauma, anxiety, or depression, 15-20 sessions are common. Some need 25+ sessions. Don’t assume therapy is short-term - plan your budget for at least 15 sessions.

Can I get therapy for less if I don’t have insurance?

Yes. About 42% of private therapists offer sliding scale fees based on income. Platforms like Open Path Collective offer sessions for $40-$70. University training clinics, staffed by supervised students, often charge 50-70% less than private practices. These are legitimate, affordable options.

What’s the out-of-pocket maximum for therapy?

In 2025, the federal out-of-pocket maximum is $9,350 for individuals and $18,700 for families. Once you hit that limit, your insurance pays 100% of covered therapy costs for the rest of the year. But only in-network expenses count toward this cap. Out-of-network payments often don’t contribute.

Alex Curran

Most people don't realize their deductible eats up half their therapy budget before the copay even kicks in

I went through this last year with anxiety therapy and ended up paying $2k before my $40 copay started

Turns out my insurance had a separate mental health deductible that wasn't listed anywhere obvious

Just called them and they said it was buried in the fine print of the PDF

Don't trust the website, call the number on your card

Allison Pannabekcer

This is so important and honestly not talked about enough

Therapy shouldn't be a financial gamble

I had to switch therapists mid-year because I hit my deductible and realized I was paying $130 a session instead of $35

Switched to a sliding scale provider through my university clinic and now pay $50

Same quality, half the cost, no insurance hassle

People need to know these options exist

Sarah McQuillan

Wow this is such a socialist narrative

Why should insurance cover therapy at all

I mean if you can't afford $125 a session maybe you shouldn't be doing it

My dad worked two jobs to pay for his own therapy back in the 80s

No insurance, no sliding scale, just grit

Now everyone wants everything handed to them

Therapy is a privilege, not a right

Aboobakar Muhammedali

I came from India where therapy was unheard of and now living in the US I'm shocked at how expensive it is

My cousin in Delhi sees a psychologist for $8 a session and it's covered by a community fund

Here I paid $900 in three months before my copay kicked in

I felt so guilty spending money on myself

But this post helped me realize it's not selfish

It's survival

Thank you for breaking it down like this

Alana Koerts

Stop overcomplicating this

You have insurance pay your copay

That's it

Everything else is just fearmongering

If you can't afford therapy then don't do it

Simple

Why are you even reading this if you're broke

Go get a second job

Problem solved

Gloria Parraz

For anyone feeling overwhelmed by this financial maze

You're not alone

I spent six months terrified to start therapy because I thought I'd be buried in bills

Then I found a local nonprofit that offered free intake sessions

They connected me with a therapist who does sliding scale

My first 10 sessions were $25 each

That's less than a weekly coffee run

It's possible

You deserve support without bankruptcy

Sahil jassy

Out of pocket max is the real game changer

My plan hit $9k cap in November and after that every session was free

But I didn't know until I checked my portal

Don't wait till December to find out

Check your balance every month

And if you're close to max

Save your last few sessions for next year

Reset the clock

It's legal and smart

Insurance doesn't want you to know this

Kathryn Featherstone

My therapist told me to ask for the allowed amount before every session

Most people don't know to do this

It changed everything for me

I found out my insurance only allowed $90 for a $150 session

So I negotiated a lower rate with my therapist

They agreed to $100 since I was paying out of pocket

Turns out they're not as rigid as you think

Just ask

Nicole Rutherford

Why are you even paying for therapy if you're so broke

You clearly don't value yourself

Or you'd just meditate or journal or do yoga

Therapy is for people who can afford to be dramatic about their problems

And now you want the government to pay for it

Pathetic

Mark Able

Hey I'm a therapist and I want to say something

Most of us don't charge $125

We charge what we need to survive

But I get it

You're stuck between a rock and a hard place

Here's what I do for people who can't pay

I barter

One client cleaned my office for 3 months

Another helped me move

Another taught me how to use TikTok

Therapy isn't just about money

It's about community

Just ask

I'm not gonna turn someone away because they can't afford $100

Chris Clark

Bro I had no idea out of network payments dont count to your max

Thought I was doing fine until I hit 15 sessions and realized I was still at $0 toward my out of pocket

Called my insurance and they said 'oh yeah that's standard'

Like why is this not on the website

Why do they make it this hard

Also just found out my deductible was $2k not $1.5k

They changed it last year and never told anyone

So much for transparency

Dorine Anthony

Just wanted to say thank you for writing this

I've been in therapy for 18 months and I finally understand why my bills are so high

Was feeling guilty about spending so much

Now I realize it's not my fault

It's the system

And I'm not alone in this

Also found out my university offers free group sessions on Tuesdays

Going next week

Small steps

William Storrs

You got this

Therapy is worth every penny

Even if it feels like you're bleeding money right now

Think of it as investing in your future self

That version of you who's sleeping better

Who's not crying in the car on the way to work

Who can hold a conversation without anxiety

That person is worth $4,000

Worth $8,000

Worth every single dollar

Keep going

You're not wasting money

You're buying back your life

James Stearns

It is imperative to acknowledge the structural inefficiencies inherent within the contemporary mental healthcare delivery framework, which, by virtue of its commodification, imposes undue financial burdens upon the populace

One must not conflate accessibility with affordability

Indeed, the normalization of therapeutic intervention as a medical necessity remains, in many jurisdictions, an aspirational rather than an operational paradigm

One might reasonably posit that the current model is antithetical to the ethos of equitable care

One must therefore exercise prudence in one's financial planning, and seek out institutions that adhere to fiduciary responsibility

Thank you for your attention to this matter