Generic Copay Assistance: How to Save on Prescription Costs

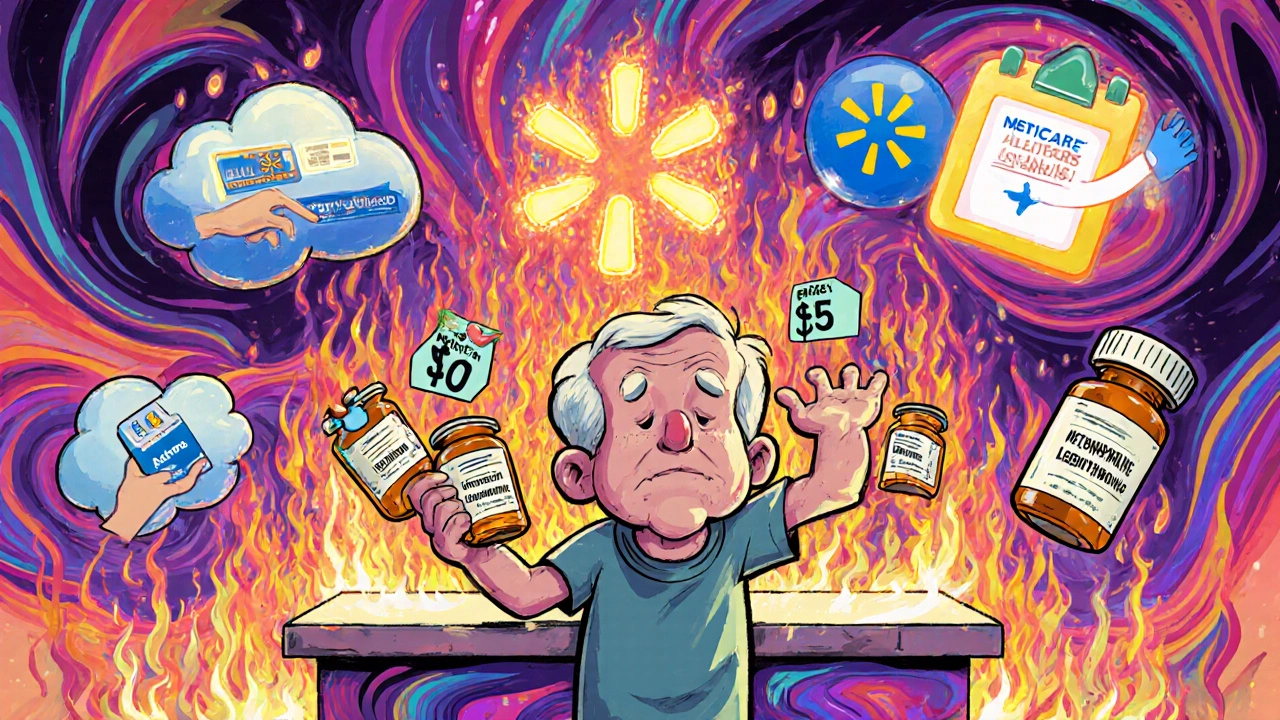

When you need a generic copay assistance, a program that helps reduce out-of-pocket costs for FDA-approved generic medications. Also known as generic drug savings programs, it’s not a government benefit you apply for like Medicaid—it’s often offered by drug manufacturers, pharmacies, or nonprofits to make everyday medicines more affordable. Many people don’t realize that even with insurance, you can still pay $20, $30, or more for a 30-day supply of a generic drug like metformin or lisinopril. That’s where these programs step in—sometimes cutting your cost to $5 or even $0.

Medicare Part D, the prescription drug coverage part of Medicare. Also known as Medicare drug plans, it’s the main place people get their generic meds covered. But even with Part D, you pay until you hit the out-of-pocket cap. In 2025, once you spend $2,000 on drugs, your plan covers nearly everything. That means if you’re taking multiple generics, your copays could drop to zero after hitting that limit. But what if you’re not there yet? That’s where generic drug affordability programs, third-party initiatives that lower costs before insurance kicks in. Also known as pharmacy discount cards, they work alongside your plan to give you lower prices at the counter. These aren’t scams. Companies like GoodRx, NeedyMeds, and even big pharmacy chains run them. Some are free to use. Others require simple registration. You don’t need to be poor. You don’t need to be on Medicaid. You just need a prescription for a generic drug.

What you’ll find in the posts below are real, practical guides on how these systems work. One post breaks down how Medicare Part D tiers affect what you pay for generics. Another explains how the new $2,000 cap changes everything for people on multiple medications. You’ll also see how some people use copay assistance to stretch their budget when they’re stuck between insurance coverage gaps. There’s no fluff. No sales pitches. Just clear info on who qualifies, how to sign up, and what to do if your pharmacy says the card doesn’t work.

Whether you’re managing high blood pressure, diabetes, or thyroid issues with generics, you’re not alone in struggling with the cost. These programs exist because the system doesn’t always make sense—especially when a $500 brand-name drug has a $3 generic version that’s just as effective. The goal isn’t to replace insurance. It’s to fill the gaps where insurance leaves you paying too much for medicine you need every day. The next time you’re handed a prescription for a generic, ask: Is there a copay card? Because there usually is, and it could save you hundreds this year.

Copay Assistance for Generics: How to Find Financial Help for Low-Cost Medications

Learn how to find real financial help for generic prescription medications, including Medicare Extra Help, pharmacy discount programs, and nonprofit options - even if you make too much for Medicaid.