Prescription Financial Aid: How to Get Help Paying for Medications

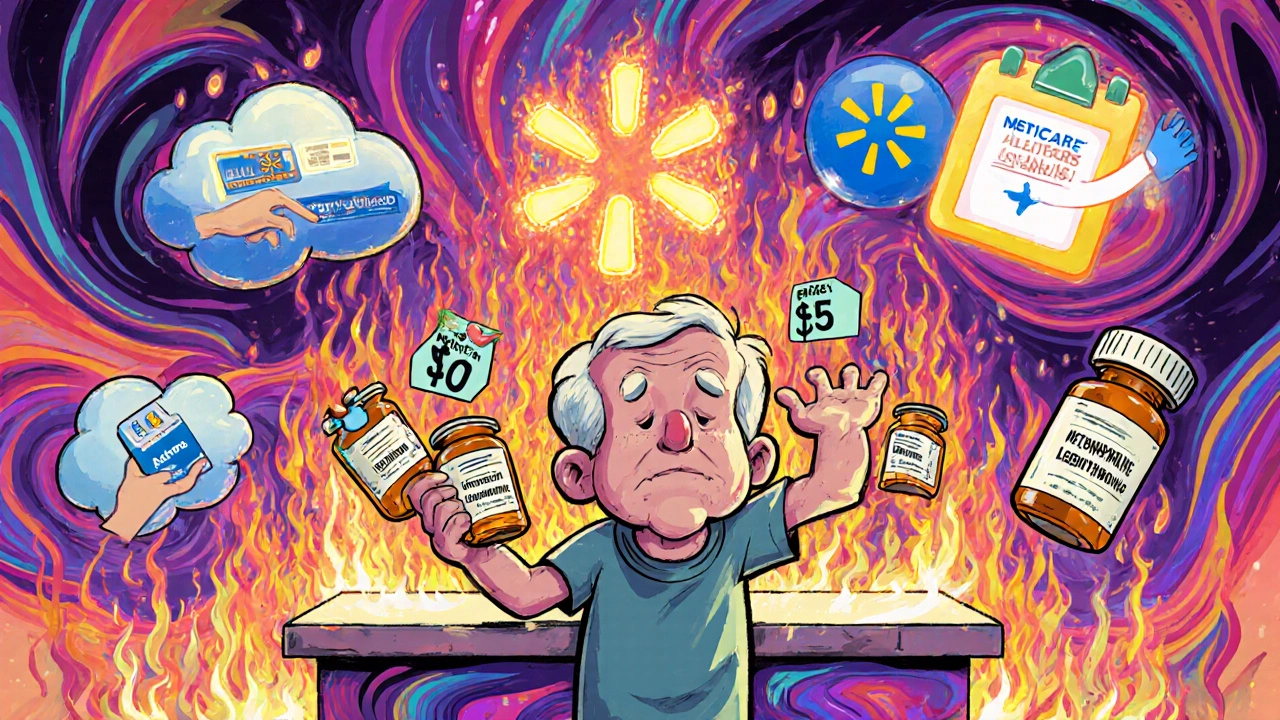

When you need a medication to stay healthy, but the price feels impossible, prescription financial aid, programs designed to help people afford necessary medications when they can’t pay full price. Also known as drug assistance programs, these resources are often hidden in plain sight—offered by drugmakers, nonprofits, and government plans, but rarely explained clearly. This isn’t about charity. It’s about access. Millions of Americans skip doses, split pills, or go without because they don’t know help exists—or think they don’t qualify.

Most people assume Medicare Part D, the federal program that helps seniors and disabled people pay for prescription drugs. Also known as Medicare prescription coverage, it is the only option. But it’s just one piece. Many plans have a coverage gap, and even with the $2,000 out-of-pocket cap in 2025, you still pay until you hit it. That’s where drug assistance programs, free or low-cost medication programs run by pharmaceutical companies for people with low income or no insurance. Also known as patient assistance programs, it steps in. Companies like Pfizer, Merck, and AbbVie offer free or deeply discounted versions of their drugs if your income is under 400% of the federal poverty level. You don’t need to be broke—just struggling.

Then there’s the real bottleneck: paperwork. Most programs ask for proof of income, a doctor’s note, and sometimes even tax forms. But you don’t need to handle it alone. Nonprofits like NeedyMeds and RxAssist walk you through the process. Some pharmacies even have on-site counselors. And if you’re on Medicaid or have a chronic condition like diabetes or high blood pressure, you might qualify for state-level programs that cover co-pays. The key isn’t waiting until you’re desperate—it’s asking early.

You’ll find posts here that break down exactly how Medicare Part D tiers work, how generics become free after hitting the cap, and what to do if your drug isn’t covered. Others show how people on long-term steroids or cancer treatments use financial aid to keep taking meds without bankruptcy. There’s even a guide on how to check if your drug has a manufacturer coupon—no phone call needed. These aren’t theoretical tips. They’re real stories from people who got help, figured out the system, and kept taking their pills.

Prescription financial aid isn’t a secret. It’s a system that’s hard to navigate. But you don’t need to be an expert. You just need to know where to look. Below, you’ll find clear, practical guides—no jargon, no fluff—on how to get your meds paid for, step by step. Whether you’re on a fixed income, dealing with a new diagnosis, or just tired of choosing between rent and refills, there’s a path here for you. Start here. You’ve already taken the first step by looking.

Copay Assistance for Generics: How to Find Financial Help for Low-Cost Medications

Learn how to find real financial help for generic prescription medications, including Medicare Extra Help, pharmacy discount programs, and nonprofit options - even if you make too much for Medicaid.